UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material | |

THE KROGER CO.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. | |||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) | ||||||

| a. | Title of each class of securities to which transaction applies: | ||||||

Aggregate number of securities to which transaction applies: | |||||||

| c. | |||||||

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |||||||

| d. | |||||||

Proposed maximum aggregate value of transaction: | |||||||

| e. | Total fee paid: | ||||||

| Fee paid previously with preliminary materials. | |||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| a. | Amount | ||||||

Form, Schedule or Registration Statement No.: | |||||||

Filing | |||||||

| party: | |||||||

Date Filed: | |||||||

Notice of 20162018 Annual Meeting of Shareholders

Fellow Kroger Shareholders:

It is our pleasure to invite you to join our Board of Directors, senior leadership, and other Kroger associates at The Kroger Co. Annual Meeting of Shareholders.

| When: | Thursday, June | |||

| Where: | ||||

Music Hall Music Hall Ballroom 1241 Elm Street Cincinnati, OH 45202 | ||||

| Items of Business: | 1. | To elect | ||

2. | To approve our executive compensation, on an advisory basis. | |||

3. | To approve an amendment to our Regulations to adopt proxy access. 4. To approve an amendment to our Regulations to permit Board amendments in accordance with Ohio law. 5. To ratify the selection of our independent auditor for fiscal year | |||

| 2018. 6. To vote on | ||||

7. To transact other business as may properly come before the meeting. | ||||

| Who can Vote: | Holders of Kroger common shares at the close of business on the record date | |||

| How to Vote: | Your vote is important! Please vote your proxy in one of the following ways: | |||

1. | Via the internet, by visiting www.proxyvote.com. | |||

2. | By telephone, by calling the number on your proxy card, voting instruction form or notice. | |||

3. | By mail, by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | |||

4. | In person, by attending the meeting in Cincinnati. | |||

| Attending the Meeting: | Shareholders holding shares at the close of business on the record date, or their duly appointed proxies, may attend the meeting. If you plan to attend the meeting, you must bring either: (1) the notice of meeting that was separately mailed to you or (2) the top portion of your proxy card, either of which will be your admission ticket. You must also bring valid photo identification, such as a driver’s license or passport. We reserve the right to exclude any person who cannot provide an admission ticket and valid photo identification. | |||

| Webcast of the Meeting: | If you are unable to attend the meeting, you may listen to a live webcast of the meeting by visiting ir.kroger.com at 11:00 a.m. eastern time on June | |||

We appreciate your continued confidence in Kroger, and we look forward to seeing you at the meeting.

| May , 2018 | By Order of the Board of Directors, | |

| Cincinnati, Ohio | Christine S. Wheatley, Secretary | |

Proxy Statement

May 12, 2016, 2018

We are providing this notice, proxy statement and annual report to the shareholders of The Kroger Co. (“Kroger”, “we”, “us”, “our”) in connection with the solicitation of proxies by the Board of Directors of Kroger (the “Board”) for use at the Annual Meeting of Shareholders to be held on June 23, 2016,28, 2018, at 11:00 a.m. eastern time, at the School for Creative and Performing Arts, Corbett Theater, 108 W. Central Parkway,Music Hall Ballroom, Music Hall, 1241 Elm St., Cincinnati, Ohio 45202, and at any adjournments thereof.

Our principal executive offices are located at 1014 Vine Street, Cincinnati, Ohio 45202-1100. Our telephone number is513-762-4000. This notice, proxy statement and annual report, and the accompanying proxy card were first furnished to shareholders on May 12, 2016., 2018.

Who can vote?

You can vote if, as of the close of business on April 27, 2016,May 2, 2018, you were a shareholder of record of Kroger common shares.

Who is asking for my vote, and who pays for this proxy solicitation?

Your proxy is being solicited by Kroger’s Board of Directors. Kroger is paying the cost of solicitation. We have hired D.F. King & Co., Inc., 48 Wall Street, New York, New York, a proxy solicitation firm, to assist us in soliciting proxies and we will pay them a fee estimated not to exceed $15,000.$17,500.

We also will reimburse banks, brokers, nominees, and other fiduciaries for postage and reasonable expenses incurred by them in forwarding the proxy material to beneficial owners of our common shares.

Proxies may be solicited personally, by telephone, electronically via the Internet, or by mail.

Who are the members of the Proxy Committee?

Robert D. Beyer, W. Rodney McMullen, and Ronald L. Sargent, all Kroger Directors, are the members of the Proxy Committee for our 20162018 Annual Meeting.

How do I vote my proxy?

You can vote your proxy in one of the following ways:

| 1. | Via the internet,by visiting www.proxyvote.com. |

| 2. | By telephone,by calling the number on your proxy card, voting instruction form, or notice. | |

| 3. | By mail,by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | |

| 4. | In person,by attending the meeting in Cincinnati. | |

What do I need to attend the meeting in person in Cincinnati?

If you plan to attend the meeting, you must bring either: (1) the notice of meeting that was separately mailed to you or (2) the top portion of your proxy card, either of which will be your admission ticket.

You must also bring valid photo identification, such as a driver’s license or passport. We reserve the right to exclude any person who cannot provide an admission ticket and valid photo identification.

Can I change or revoke my proxy?

The common shares represented by each proxy will be voted in the manner you specified unless your proxy is revoked before it is exercised. You may change or revoke your proxy by providing written

1

notice to Kroger’s Secretary at 1014 Vine Street, Cincinnati, Ohio 45202-1100,45202, in person at the meeting or by executing and sending us a subsequent proxy.

How many shares are outstanding?

As of the close of business on April 27, 2016,May 2, 2018, the record date, our outstanding voting securities consisted of 953,786,557 common shares.

1

How many votes per share?

Each common share outstanding on the record date will be entitled to one vote on each of the 11 director nominees and one vote on each other proposal. Shareholders may not cumulate votes in the election of directors.

What voting instructions can I provide?

You may instruct the proxies to vote “For” or “Against” each proposal. Orproposal, or you may instruct the proxies to “Abstain” from voting.

What happens if proxy cards or voting instruction forms are returned without instructions?

If you are a registered shareholder and you return your proxy card without instructions, the Proxy Committee will vote in accordance with the recommendations of the Board of Directors.Board.

If you hold shares in street name and do not provide your broker with specific voting instructions on proposals 1, 2, 3, 4, 5, 6, 7, or 7,8, which are considerednon-routine matters, your broker does not have the authority to vote on those proposals. This is generally referred to as a “brokernon-vote.” Proposal 3,5, ratification of auditors, is considered a routine matter and, therefore, your broker may vote your shares according to your broker’s discretion.

The vote required, including the effect of brokernon-votes and abstentions for each of the matters presented for shareholder vote, is set forth below.

What are the voting requirements for each of the proposals?

Proposal No. 1 Election of Directors – An affirmative vote of the majority of the total number of votes cast “For” or “Against” a director nominee is required for the election of a director in an uncontested election. A majority of votes cast means that the number of shares voted “For” a director nominee must exceed the number of votes “Against” such director. Brokernon-votes and abstentions will have no effect on this proposal.

Proposal No. 2 Advisory Vote to Approve Executive Compensation – Advisory approval by shareholders of executive compensation requires the affirmative vote of the majority of shares participating in the voting. Brokernon-votes and abstentions will have no effect on this proposal.

Proposal No. 3 Vote to Approve Amendment to Regulations to Permit Proxy Access – An affirmative vote of the majority of the outstanding shares is required to amend the Regulations to permit proxy access. Brokernon-votes and abstentions will have the same effect as a vote against this proposal.

Proposal No. 4 Vote to Approve Amendment to Regulations to Permit Board Amendments in Accordance with Ohio Law – An affirmative vote of 75% of the outstanding shares is required to amend the Regulations to permit Board amendments of certain provisions. Brokernon-votes and abstentions will have the same effect as a vote against this proposal.

Proposal No. 5 Ratification of Independent Auditors – Ratification by shareholders of the selection of independent public accountants requires the affirmative vote of the majority of shares participating in the voting. Abstentions will have no effect on this proposal.

2

Proposal Nos. 4, 5, 6, 7, and 7,8 Shareholder Proposals– The affirmative vote of the majority of shares participating in the voting on a shareholder proposal is required for such proposal to pass. Accordingly, brokernon-votes and abstentions will have no effect on these proposals. Proxies will be voted against these proposals unless the Proxy Committee is otherwise instructed on a proxy properly executed and returned.

How does the Board of Directors recommend that I vote?

Proposal | For More | Board | ||||||||

Item No. 1 Election of Directors | See page 5 | FOR | ||||||||

Item No. 2 Advisory Vote to Approve Executive Compensation | See page 56 | FOR | ||||||||

Item No. 3 Amendment to Regulations to Permit Proxy Access | See page | FOR | ||||||||

Item No. | See page 59 | FOR | ||||||||

Item No. 5 Ratification of Independent Auditors | See page 60 | FOR | ||||||||

Item Nos. 6, 7, and 8 Shareholder Proposals | ||||||||||

| AGAINST | ||||||||||

Important Notice Regarding the Availability of Proxy Materials for the Shareholder

Meeting to be Held on June 23, 2016

The Notice of 20162018 Annual Meeting, Proxy Statement and 20152017 Annual Report and the means to vote by internet are available at www.proxyvote.com.

2

3

Kroger’s Corporate Governance Practices

Kroger is committed to strong corporate governance. We believe that strong governance builds trust and promotes the long-term interests of our shareholders. Highlights of our corporate governance practices include the following:

Board Governance Practices

| ✓ | Strong Board oversight of enterprise risk. |

| ✓ | All director nominees are independent, except for the CEO. |

| ✓ | All five Board |

| ✓ | ethics. |

| ✓ | |||

| Annual evaluation of the Chairman and CEO by the independent directors, led by the independent Lead Director. |

| ✓ | Annual Board and committee self-assessments. |

| ✓ | Commitment to Board refreshment and diversity. |

| ✓ | Regular executive sessions of the independent directors, at the Board and committee level. |

| ✓ | Strong independent Lead Director with clearly defined role and responsibilities. |

| ✓ | High degree of Board interaction with management to ensure successful oversight and succession planning. |

Shareholder Rights

| ✓ | All directors are elected annually with a simple majority standard for all uncontested director elections and by plurality in contested director elections. |

| ✓ | No poison pill (shareholder rights plan). |

| ✓ | Shareholders have the right to call a special meeting. |

| ✓ | Regular engagement with shareholders to understand their perspectives and concerns on a broad array of topics, including corporate governance matters. |

| ✓ | Responsive to shareholder feedback. |

Compensation Governance

| ✓ | Pay program tied to performance and business strategy. |

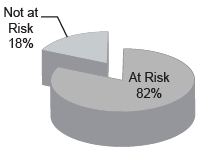

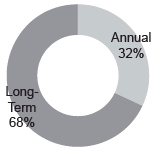

| ✓ | Majority of pay is long-term andat-risk with no guaranteed bonuses or salary increases. |

| ✓ | Stock ownership guidelines align executive and director interests with those of shareholders. |

| ✓ | Prohibition on all hedging, pledging and short sales of Kroger securities by directors and executive officers. |

| ✓ | No | ||

3

4

Proposals to Shareholders

Item No. 1. Election of Directors

You are being asked to elect 11 director nominees for aone-year term. The Board of Directors recommends that you vote FOR the election of all director nominees.

As of the date of this proxy statement, the KrogerKroger’s Board of Directors consists of twelve11 members. David B. Lewis will be retiring from the Board of Directors immediately prior to the 2016 annual meeting, in accordance with Kroger’s director retirement policy, and will not be standing for re-election. The number of directors will be reduced to eleven by the Board. All nominees, if elected at the 2016 annual meeting,2018 Annual Meeting, will serve until the annual meeting in 2017,2019, or until their successors have been elected by the shareholders or by the Board pursuant to Kroger’s Regulations, and qualified.

Kroger’s Articles of Incorporation provide that the vote required for election of a director nominee by the shareholders, except in a contested election or when cumulative voting is in effect, is the affirmative vote of a majority of the votes cast for or against the election of a nominee.

The experience, qualifications, attributes, and skills that led the Corporate Governance Committee and the Board to conclude that the following individuals should serve as directors are set forth opposite each individual’s name. The committee memberships stated below are those in effect as of the date of this proxy statement. Except as noted, each nominee has been employed by his or her present employer (or a subsidiary thereof) in an executive capacity for at least five years.

Nominees for Directors for Terms of Office Continuing until 20172019

Nora A. Aufreiter Age Director Since 2014 Committees: | Ms. Aufreiter is a Director Emeritus of McKinsey & Company, a global management consulting firm. She retired in June 2014 after more than 27 years with McKinsey, most recently as a director and senior partner. During that time, she worked extensively in the U.S., Canada, and internationally with major retailers, financial institutions and other consumer-facing companies. Before joining McKinsey, Ms. Aufreiter spent three years in financial services working in corporate finance and investment banking. She is a member of the Board of Directors of The Bank of Nova Scotia, The Neiman Marcus Group, and Cadillac Fairview, one of North America’s largest owners, operators and developers of commercial real estate. Ms. Aufreiter also serves on the boards of St. Michael’s Hospital and the Canadian Opera Company, and is a member of the Dean’s Advisory Board for the Ivey Business School in Ontario, Canada. Ms. Aufreiter has over 30 years of broad business experience in a variety of retail sectors. Her vast experience in leading McKinsey’s North American Retail Practice, North American Branding service line and the Consumer Digital and Omnichannel service line is of particular value to the Board. She also brings to the Board valuable insight on commercial real estate. | |

4

5

Robert D. Beyer Age Director Since 1999 Committees: | Mr. Beyer is Chairman of Chaparal Investments LLC, a private investment firm and holding company that he founded in 2009. From 2005 to 2009, Mr. Beyer served as Chief Executive Officer of The TCW Group, Inc., a global investment management firm. From 2000 to 2005, he served as President and Chief Investment Officer of Trust Company of the West, the principal operating subsidiary of TCW. Mr. Beyer is a member of the Board of Directors of Mr. Beyer brings to Kroger his experience as CEO of TCW, a global investment management firm serving many of the largest institutional investors in the U.S. He has exceptional insight into Kroger’s financial strategy, and his experience qualifies him to serve as a member of the Board. While at TCW, he also conceived and developed the firm’s risk management infrastructure, an experience that is useful to Kroger’s Board in performing its risk management oversight functions. His abilities and service as a director were recognized by his peers, who selected Mr. Beyer as an Outstanding Director in 2008 as part of the Outstanding Directors Program of the Financial Times. His strong insights into corporate governance form the foundation of his leadership role as Lead Director on the Board. | |

Anne Gates Age Director Since 2015 Committees: | Ms. Gates Ms. Gates has over | |

| * | Denotes Committee Chair |

6

Susan J. Kropf Age Director Since 2007 Committees: | Ms. Kropf was President and Chief Operating Officer of Avon Products Inc., a manufacturer and marketer of beauty care products, from 2001 until her retirement in January 2007. She joined Avon in 1970 and, during her tenure at Avon, Ms. Kropf also served as Executive Vice President and Chief Operating Officer, Avon North America and Global Business Operations from 1998 to 2000 and President, Avon U.S. from 1997 to 1998. Ms. Kropf was a member of Avon’s Board of Directors from 1998 to 2006. She currently is a director of Avon Products, Inc., Tapestry, Inc. (formerly known as Coach, Inc.), and Sherwin Williams Company. In the past five years she also served as a director of MeadWestvaco Corporation. Ms. Kropf has unique and valuable consumer insight, having led a major, publicly-traded retailer of beauty and related consumer products. She has extensive experience in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger’s Board. Ms. Kropf has a strong financial background, and has significant boardroom experience through her service on the boards of various public companies, including experience serving on compensation, audit, and corporate governance committees. She was inducted into the YWCA Academy of Women Achievers. Ms. Kropf received recognition from the National Association of Corporate Directors as an NACD Directorship 100 “Class of 2016” member. | |

5

W. Rodney McMullen Age Director Since 2003 | Mr. McMullen was elected Chairman of the Board in January 2015 and Chief Executive Officer of Kroger in January 2014. Mr. McMullen served as Kroger’s President and Chief Operating Officer from August 2009 to December 2013. Prior to that role, Mr. McMullen was elected to various roles at Kroger including Vice Chairman in 2003, Executive Vice President in 1999 and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation and VF Corporation. Mr. McMullen has broad experience in the supermarket business, having spent his career spanning over | |

Jorge P. Montoya Age Director Since 2007 Committees: | Mr. Montoya was President of The Procter & Gamble Company’s Global Snacks & Beverage division, and President of Procter & Gamble Latin America, from 1999 until his retirement in 2004. Prior to that, he was an Executive Vice President of Procter & Gamble, a provider of branded consumer packaged goods, from 1995 to 1999. Mr. Montoya is a director of The Gap, Inc. Mr. Montoya brings to Kroger’s Board over 30 years of leadership experience at a premier consumer products company. He has a deep knowledge of the Hispanic market, as well as consumer products and retail operations. Mr. Montoya has vast experience in marketing and general management, including international business. He was named among the 50 most important Hispanics in Business & Technology, inHispanic Engineer & Information Technology Magazine. | |

| * | Denotes Committee Chair |

7

Clyde R. Moore Age Director Since 1997 Committees: | Mr. Moore was the Chairman of First Service Networks, a national provider of facility and maintenance repair services, until his retirement in 2015. Prior to Mr. Moore has over 30 years of general management experience in public and private companies. He has sound experience as a corporate leader overseeing all aspects of a facilities management firm and numerous manufacturing companies. Mr. Moore’s expertise broadens the scope of the Board’s experience to provide oversight to Kroger’s facilities, digital and manufacturing businesses. Additionally, his expertise and leadership as Chair of the Compensation and Talent Development Committee is of particular value to the Board. | |

Age 71

|

| |

6

Director Since 2006 Committees: | Mr. Runde is a special advisor and a former Vice Chairman of Morgan Stanley, a financial services provider, where he was employed from 1974 until his retirement in 2015. He was a member of the Board of Directors of Burlington Resources, Inc. prior to its acquisition by ConocoPhillips in 2006. Mr. Runde serves as a Trustee Emeritus of Marquette University and the Pierpont Morgan Library. Mr. Runde brings to Kroger’s Board a strong financial background, having led a major financial services provider. He also has served on the compensation committee of a major corporation. | |

Ronald L. Sargent Age Director Since 2006 Committees: | Mr. Sargent is the former Chairman and Chief Executive Officer of Staples, Inc., a business products retailer, where he Mr. Sargent has over 35 years of retail experience, first with Kroger and then with increasing levels of responsibility and leadership at Staples, Inc. His efforts helped carve out a new market niche for the international | |

Bobby S. Shackouls Age Director Since 1999 Committees: | Mr. Shackouls was Chairman of the Board of Burlington Resources Inc., a natural resources business, from July 1997 until its merger with ConocoPhillips in 2006 and its President and Chief Executive Officer from December 1995 until 2006. Mr. Shackouls was also the President and Chief Executive Officer of Burlington Resources Oil and Gas Company (formerly known as Meridian Oil Inc.), a wholly-owned subsidiary of Burlington Resources, from 1994 to 1995. Mr. Shackouls is a director of Plains GP Holdings, Mr. Shackouls brings to the Board the critical thinking that comes with a chemical engineering background, as well as his experience leading a major natural resources company, coupled with his corporate governance expertise. | |

| * | Denotes Committee Chair |

8

Mark S. Sutton Age 56 Director Since 2017 Committees: Audit Public Responsibilities | Mr. Sutton is Chairman and Chief Executive Officer of International Paper, a leading global producer of renewable fiber-based packaging, pulp and paper products. Prior to becoming CEO, he served as President and Chief Operating Officer with responsibility for running the company’s global business. Mr. Sutton joined International Paper in 1984 as an electrical engineer. He held roles of increasing responsibility throughout his career, including mill manager, Vice President of corrugated packaging operations across Europe, the Middle East and Africa, Vice President of corporate strategic planning, and Senior Vice President of several business units, including global supply chain, before being named CEO in 2014. He serves on the boards of the American Forest & Paper Association, the Business Roundtable, the International Advisory Board of the Moscow School of Management — Skolkovo, Memphis Tomorrow and the New Memphis Institute. Mr. Sutton has over thirty years of leadership experience with increasing levels of responsibility and leadership at International Paper. He brings to the Board the critical thinking that comes with an electrical engineering background as well as his experience leading a global company. His strong strategic planning background and supply chain experience are of particular value to the Board. Mr. Sutton has been designated an Audit Committee financial expert. | |

The Board of Directors Recommends a VoteFor Each Director Nominee.

Diversity of Background

Our director nominees possess relevant experience, skills and qualifications that contribute to a well-functioning Board that effectively oversees the Company’s strategy and management. Listed below are the skills and experience that we consider important for our directors in light of our current business, strategy and structure:

Nora | Robert Beyer | Anne Gates | Susan Kropf | Rodney McMullen | Jorge Montoya | Clyde Moore | James Runde | Ronald Sargent | Bobby Shackouls | Mark Sutton | Total (of 11) | |||||||||||||||||||||||||||||||||||||||||||||||||

Business Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||

Retail | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expertise | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Risk Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Operations &Technology | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Sustainability | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Manufacturing | 🌑 | 🌑 | 🌑 | 🌑 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

9

|  |

Information Concerning the Board of Directors

Board Leadership Structure and Lead Independent Director

The Board is currently composed of eleventen independentnon-employee directors and one management director, Mr. McMullen, the Chairman and CEO. Kroger has a balanced governance structure in which independent directors exercise meaningful and vigorous oversight.

In addition, asAs provided in theKroger’sGuidelines on Issues of Corporate Governance(the “Guidelines”), the Board has designated one of the independent directors as Lead Director. The Lead Director works with the Chairman to share governance responsibilities, facilitate the development of Kroger’s strategy and grow shareholder value. The Lead Director serves a variety of roles, consistent with current best practices, including:

The Lead Director carries out these responsibilities in numerous ways, including:

| |

Unless otherwise determined by the independent members of the Board, the chairChair of the Corporate Governance Committee is designated as the Lead Director. Robert D. Beyer, an

10

independent director and the chairChair of the Corporate Governance Committee, is currently the Lead Director. Mr. Beyer is an effective Lead Director for Kroger due to, among other things, things:

With respect to the roles of Chairman and CEO, theGuidelines provide that the Board will determine whenwhether it is in the best interests of Kroger and our shareholders for the roles to be separated or combined, and thecombined. The Board exercises its discretionthis judgment as it deems appropriate in light of prevailing circumstances. Upon retirement of our former Chairman, David B. Dillon, on December 31, 2014, the Board determined that it is in the best interests of Kroger and our shareholders for one person to serve as the Chairman and CEO, as was the case from 2004 through 2013.2013, with another individual serving as independent Lead Director. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interestsinterest of shareholders. Additionally, this structure provides an effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. The Board believes that the combination or separationstructure of these positionsthe Chairman and independent Lead Director position should continue to be considered as part of the succession planning process, as was the case in 2003 and 2014 when the roles were separated.process.

8Annual Board Evaluation Process

The Board and each of its committees conduct an annual self-evaluation to determine whether the Board is functioning effectively both at each level.the Board and at the committee levels. As part of this annual self-evaluation, the Board assesses whether the current leadership structure and function continues to be appropriate for Kroger and its shareholders. TheGuidelines provide the flexibility for the Board to modify our leadership structure in the future as appropriate. We believe that Kroger, like many U.S. companies, has beenis well-served by this flexible leadership structure.

The Board recognizes that a robust evaluation process is an essential component of strong corporate governance practices and promoting Board effectiveness. The Corporate Governance Committee oversees an annual evaluation process led by the Lead Independent Director (who also serves as Chair of the Corporate Governance Committee).

Each director completes an annual self-evaluation of the Board and the committees on which he or she serves. These self-evaluations are designed to help assess the skills, qualifications, and experience represented on the Board and its committees, and to determine whether the Board and its committees are functioning effectively. The results of this annual self-evaluation are discussed by the full Board and each committee, as applicable, and changes to the Board’s and its committees’ practices are implemented as appropriate.

Committees of the Board of Directors

To assist the Board in undertaking its responsibilities, and to allow deeper engagement in certain areas of company oversight, the Board has established five standing committees: Audit, Compensation and Talent Development (“Compensation”), Corporate Governance, Financial Policy and Public Responsibilities. All committees are composed exclusively of independent directors, as determined under the NYSE listing standards. The current charter of each Board committee is available on our website at ir.kroger.com under Corporate Governance –Investors —Governance — Committee Composition.

11

| Name of Committee, Number of Meetings, and Current Members | Committee Functions | |

Audit Committee Meetings in Members: | • Oversees the Company’s financial reporting and accounting matters, including review of the Company’s financial statements and the audit thereof, the Company’s financial reporting and accounting process, and the Company’s systems of internal control over financial reporting • Selects, evaluates and oversees the compensation and work of the independent registered public accounting firm and reviews its performance, qualifications, and independence • Oversees and evaluates the Company’s internal audit function, including review of its audit plan, policies and procedures and significant findings • Oversees risk assessment and risk management, including review of cybersecurity risks as well as legal or regulatory matters that could have a significant effect on the Company • Reviews and monitors the Company’s compliance programs, including the whistleblower program | |

Compensation Committee Meetings in Members: | • Recommends for approval by the independent directors the compensation of the CEO, and • Administers the Company’s executive compensation policies and programs, including determining grants of equity awards under the plans • Has sole authority to retain and direct the committee’s compensation consultant • Assists the full Board with senior management succession planning | |

Corporate Governance Committee Meetings in 2017: 2 Members: | • Oversees the Company’s corporate governance policies and procedures • Develops criteria for selecting and retaining directors, including identifying and recommending qualified candidates to be director nominees • Designates membership and Chairs of Board committees • Reviews the Board’s performance and director independence • Establishes and reviews the practices and procedures by which the Board performs its functions | |

9

12

| Name of Committee, Number of Meetings, and Current Members | Committee Functions | |

| ||

Financial Policy Committee Meetings in Members: | • Reviews and recommends financial policies and practices • Oversees management of the Company’s financial resources • Reviews the Company’s annual financial plan, significant capital investments, plans for major acquisitions or sales, issuance of new common or preferred stock, dividend policy, creation of additional debt and other capital structure considerations including additional leverage or dilution in ownership • Monitors the investment management of assets held in pension and profit sharing plans administered by the Company | |

Public Responsibilities Committee Meetings in Members: | • Reviews the Company’s policies and practices affecting its social and public responsibility as a corporate citizen, including: community relations, charitable giving, supplier diversity, sustainability, government relations, political action, consumer and media relations, food and pharmacy safety and the safety of customers and employees • Reviews and examines the Company’s evaluation of and response to changing public expectations and public issues affecting the business | |

Director Nominee Selection Process

The Corporate Governance Committee is responsible for recommending to the Board a slate of nominees for election at each annual meeting of shareholders. The Corporate Governance Committee recruits candidates for Board membership through its own efforts and through recommendations from other directors and shareholders. In addition, the Corporate Governance Committee has retained an independent search firm to assist in identifying and recruiting director candidates who meet the criteria established by the Corporate Governance Committee.

These criteria are:

10

The Corporate Governance Committee also considers the specific experience and abilities of director candidates in light of our current business, strategy and structure and the current or expected needs of the Board in its identification and recruitment of director candidates.

13

Board Diversity and Succession Planning

Our director nominees reflect a wide array of experience, skills and backgrounds. Each director is individually qualified to make unique and substantial contributions to Kroger. Collectively, our directors’ diverse viewpoints and independent-mindedness enhance the quality and effectiveness of Board deliberations and decision making. Our Board is a dynamic group of new and experienced members, providing an appropriate balance of institutional knowledge and fresh perspectives about Kroger due to the varied length of tenure on the Board. This blend of qualifications, attributes and tenure results in highly effective board leadership.

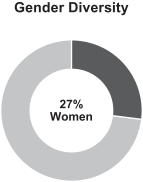

The Corporate Governance Committee considers racial, ethnic and gender diversity to be important elements in promoting full, open and balanced deliberations of issues presented to the Board. The Corporate Governance Committee considers director candidates that help the Board reflect the diversity of our shareholders, associates, customers and the communities in which we operate. Some consideration also is given to the geographic location of director candidates in order to provide a reasonable distribution of members from Kroger’s operating areas.

At least annually, theBoard succession planning is an ongoing, year-round process. The Corporate Governance Committee activelyrecognizes the importance of thoughtful Board refreshment, and engages in a continuing process of identifying attributes sought for future Board succession planning.members. The Corporate Governance Committee takes into account the Board and committee evaluations regarding the specific backgrounds,qualities, skills, and experiences that would contribute to overall Board and committee effectiveness, as well as the future needs of the Board and its committees in light of Kroger’s current and futurelong-term business strategies, and the skills and qualifications of directors who are expected to retire in the future.

Shareholder Engagement

Maintaining ongoing relationships with our shareholders, and understanding our shareholders’ views, is a priority for both our Board and management team. We have a longstanding history of engaging with our shareholders through our investor relations team’s year-round outreach program. At the direction of our Board, we expanded our shareholder engagement program in 2016 to include outreach to our largest shareholders’ governance teams. In 2017, we requested meetings with shareholders representing nearly 40% of our outstanding shares and ultimately engaged with shareholders representing over a third of our outstanding shares.

During these engagements, we discussed and solicited feedback on a range of topics, including business strategy, corporate governance, executive compensation and sustainability. In addition, we attended industry events to further engage with shareholders and subject matter experts. These conversations provided valuable insights into our shareholders’ perspectives and their feedback was shared with, and considered by, our full Board.

Candidates Nominated by Shareholders

The Corporate Governance Committee will consider shareholder recommendations for director nominees for membership onelection to the Board of Directors.Board. If shareholders wish to nominate a person or persons for election to the Board at our 20172019 annual meeting, written notice must be submitted to Kroger’s Secretary, and received at our executive offices, in accordance with Kroger’s Regulations, not later than March 28, 2017.31, 2019. Such notice should include the name, age, business address and residence address of such person, the principal occupation or employment of such person, the number of Kroger common shares owned of record or beneficially by such person and any other information relating to the person that would be required to be included in a proxy statement relating to the election of directors. The Secretary will forward the information to the Corporate Governance Committee for its consideration. The Corporate Governance Committee will use the same criteria in evaluating candidates submitted by shareholders as it uses in evaluating candidates identified by the Corporate Governance Committee, as described above. See “Director Nominee Selection Process.”

14

If Item No. 3 on proxy access is approved by the requisite vote at the 2018 Annual Meeting, eligible shareholders will have the ability to submit director nominees for inclusion in our proxy statement for the 2019 annual meeting of shareholders. As described in more detail in Item No. 3, to be eligible, shareholders must have owned at least 3% of our common shares for at least three years. Up to 20 shareholders will be able to aggregate for this purpose. Nominations must be submitted to our Corporate Secretary at our principal executive offices no earlier than December , 2018 and no later than January __, 2019.

Corporate Governance Guidelines

The Board has adopted theGuidelines on Issues of Corporate Governance. TheGuidelines, which includeincludes copies of the current charters for each of the five standing committees of the Board,Board. TheGuidelines are available on our website at ir.kroger.com under CorporateInvestors – Governance – Highlights.Guidelines on Issues of Corporate Governance. Shareholders may also obtain a copy of theGuidelines by making a written request to Kroger’s Secretary at our executive offices.

Independence

The Board has determined that all of thenon-employee directors have no material relationships with Kroger and therefore,satisfy the criteria for independence set forth in Rule 303A.02 of the New York Stock Exchange Listed Company Manual. Therefore, allnon-employee directors are independent for purposes of the New York Stock ExchangeNYSE listing standards. The Board made its determination based on information furnished by all members regarding their relationships with Kroger and its management, and other relevant information. After reviewing The Board considered, among other things, that

In determining that Mr. Sargent is independent, the Board considered transactions during fiscal 2015 between Kroger and Staples, Inc. (where Mr. Sargent is Chairman and CEO) and determined that the amount of business fell below the thresholds set by the NYSE listing standards. The transactions involved the purchase of goods bystandards, and

11

Audit Committee Expertise

The Board has determined that Anne Gates, Susan M. Phillips and Ronald L. Sargent and Mark S. Sutton, independent directors who are members of the Audit Committee, are “audit committee financial experts” as defined by applicable SEC regulations and that all members of the Audit Committee are “financially literate” as that term is used in the NYSE listing standards and are independent in accordance with Rule10A-3 of the Securities Exchange Act of 1934.

Code of Ethics

The Board has adoptedThe Kroger Co. Policy on Business Ethics, applicable to all officers, employees and directors, including Kroger’s principal executive, financial and accounting officers. ThePolicy is available on our website at ir.kroger.com under CorporateInvestors – Governance – Highlights.Policy on Business Ethics. Shareholders may also obtain a copy of thePolicy by making a written request to Kroger’s Secretary at our executive offices.

Communications with the Board

The Board has established two separate mechanisms for shareholders and interested parties to communicate with the Board. Any shareholder or interested party who has concerns regarding accounting, improper use of Kroger assets or ethical improprieties may report these concerns via the toll-free hotline(800-689-4609) or email address (helpline@kroger.com) established by the Board’s Audit Committee. The concerns are investigated by Kroger’s Vice President, Chief Ethics and Compliance Officer and the Vice President of AuditingInternal Audit and reported to the Audit Committee as deemed appropriate by the Vice President of Auditing.appropriate.

Shareholders or interested parties also may communicate with the Board in writing directed to Kroger’s Secretary at our executive offices. Communications relating to personnel issues or our

15

ordinary business operations, or seeking to do business with us, will be forwarded to the business unit of Kroger that the Secretary deems appropriate. All other communications will be forwarded to the chairChair of the Corporate Governance Committee for further consideration. The chairChair of the Corporate Governance Committee will take such action as he or she deems appropriate, which may include referral to the full Corporate Governance Committee or the entire Board.

Attendance

The Board held fivesix meetings in fiscal year 2015.2017. During fiscal year 2015,2017, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and committees on which that director served. Members of the Board are expected to use their best efforts to attend all annual meetings of shareholders. All eleven11 members then serving on the Board attended last year’s annual meeting.

Independent Compensation Consultants

The Compensation Committee directly engages a compensation consultant from Mercer Human Resource Consulting to advise the Compensation Committee in the design of Kroger’s executive compensation. The Committee retained a consultant from Mercer Human Resource Consulting (“Mercer”) from 2001 through December 2017. Retained by and reporting directly to the Compensation Committee, Mercer provided the Committee with assistance in evaluating Kroger’s executive compensation programs and policies.

In 2015,fiscal 2017, Kroger paid that consultant $390,767Mercer $361,147 for work performed for the Compensation Committee. Kroger, on management’s recommendation, retained the parent and affiliated companies of Mercer Human Resource Consulting to provide other services for Kroger in 2015,fiscal 2017, for which Kroger paid $2,339,577.$8,394,369. These other services primarily related to insurance claims (for which Kroger was reimbursed by insurance carriers as claims were adjusted), insurance brokerage and bonding commissions provided by Marsh USA Inc., and pension plan compliance and actuary services provided by Mercer Inc. Kroger also made payments to affiliated companies for insurance premiums that were collected by the affiliated companies of Mercer on behalf of insurance carriers, but these amounts are not included in the totals referenced above, as the amounts were paid over to insurance carriers for services provided by those carriers.

12

Although neither Neither the Compensation Committee nor the Board expressly approved the other services afterprovided by Mercer. After taking into consideration the NYSE’s independence standards and the SEC rules, the Compensation Committee determined that the Mercer consultant iswas independent and hisMercer’s work has not raised any conflict of interest because:

In July 2017, the Committee invited proposals from other executive compensation consulting firms. Following consideration of several firms, in December 2017, the Committee engaged Korn Ferry Hay Group (“Korn Ferry”) as its executive compensation consultant. Due to the timing of the engagement, Korn Ferry did not have an opportunity to assist the Committee with the design and development of the executive compensation programs for fiscal 2017, other than assisting in the final determination of fiscal 2017 payouts.

After taking into consideration the NYSE’s independence standards and the SEC rules, the Compensation Committee determined that the Korn Ferry consultant was independent and Korn Ferry’s work has not raised any conflict of interest.

16

The Compensation Committee may engage an additional compensation consultant from time to time as it deems advisable.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was an officer or employee of Kroger during fiscal 2015,2017, and no member of the Compensation Committee is a former officer of Kroger or was a party to any disclosable related person transaction involving Kroger.Kroger required to be disclosed under Item 404 of RegulationS-K. During fiscal 2015,2017, none of our executive officers served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of Kroger’s Board of Directors or Compensation Committee of the Board.

Board Oversight of Enterprise Risk

While risk management is primarily the responsibility of Kroger’s management team, the Board is responsible for strategic planning and overall supervision of our risk management activities. The Board’s oversight of the material risks faced by Kroger occurs at both the full Board level and at the committee level.

The Board receives presentations throughout the year from various department and business unit leaders that include discussion of significant risks as necessary. At each Board meeting, the Chairman and CEO addresses matters of particular importance or concern, including any significant areas of risk that require Board attention. Additionally, through dedicated sessions focusing entirely on corporate strategy, the full Board reviews in detail Kroger’s short- and long-term strategies, including consideration of significant risks facing Kroger and their potential impact. The independent directors, in executive sessions led by the Lead Director, address matters of particular concern, including significant areas of risk, that warrant further discussion or consideration outside the presence of Kroger employees. At the committee level, reports are given by management subject matter experts to each committee on risks within the scope of their charters.

The Audit Committee has oversight responsibility not only for financial reporting of Kroger’s major financial exposures and the steps management has taken to monitor and control those exposures, but also for the effectiveness of management’s processes that monitor and manage key business risks facing Kroger, as well as the major areas of risk exposure, and management’s efforts to monitor and control that exposure.the major areas of risk exposure including cybersecurity risk. The Audit Committee incorporates its risk oversight function into its regular reports to the Board and also discusses with management its policies with respect to risk assessment and risk management.

Management including our Chief Ethics and Compliance Officer, provides regular updates throughout the year to the respective Board committees regarding management of the risks they oversee,oversee. For example, our Vice President, Chief Ethics and each of these committeesCompliance Officer provides regular updates to the Audit Committee on our compliance risks and actions taken to mitigate that risk; and our Executive Vice President and Chief Information Officer and our Chief Information Security Officer provide regular updates on our cybersecurity risks and actions taken to mitigate that risk to the Audit Committee. The Audit Committee reports on risk to the full Board at each regular meeting of the Board.

We believe that our approach to risk oversight, as described above, optimizes our ability to assess inter-relationships among the various risks, make informed cost-benefit decisions, and approach emerging risks in a proactive manner for Kroger. We also believe that our risk structure complements our current Board leadership structure, as it allows our independent directors, through the five fully independent Board committees, and in executive sessions of independent directors led by the Lead Director, to exercise effective oversight of the actions of management, led by Mr. McMullen as Chairman of the Board and CEO, in identifying risks and implementing effective risk management policies and controls.

13

Compensation Discussion and Analysis

Executive Summary17

Named Executive Officers

Director Compensation

This2017 Director Compensation Discussion and Analysis provides a discussion and analysis of our compensation program for our named executive officers (“NEOs”). For the 2015 fiscal year ended January 30, 2016, the NEOs were:

Messrs. Schlotman, Donnelly, Hjelm and Morganthall were each promoted to the position of Executive Vice President effective September 1, 2015.

Executive Compensation in Context: Our Growth Plan, Financial Strategy and Fiscal Year 2015 Results

Kroger’s growth plan includes four key performance indicators: positive identical supermarket sales without fuel (“ID Sales”) growth, slightly expanding non-fuel first in, first out (“FIFO”) operating margin, growing return on invested capital (“ROIC”), and annual market share growth. In 2015, we met or exceeded our goals for each of these performance indicators:

The compensation of our NEOs in 2015 reflects Kroger’s short-term and long-term goals and outcomes. Total compensation for the year is an indicator of how well Kroger performed compared to our business plan, reflecting how our compensation program responds to business challenges and the marketplace.

14

Summary of Key Compensation Practices

Summary of Fixed and At-Risk Pay Elements

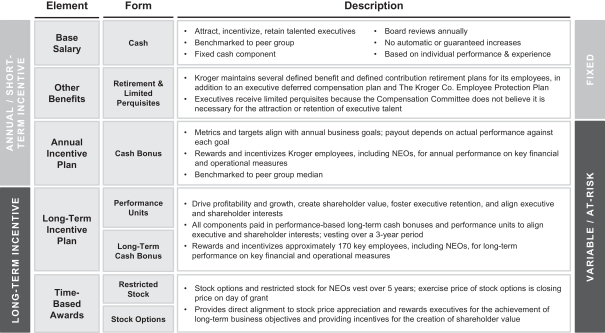

The fixed and at-risk pay elements of NEO compensation are reflected in the following table and charts. The amounts used in the charts are based on the amounts reported in the Summary Compensation Table for 2015, excluding the Change in Pension Value and Nonqualified Deferred Compensation Earnings column.

| |||||

15

| |||||

|

| |

|

|

16

|

|

The following discussion and analysis addresses the compensation of the NEOs and the factors considered by the Compensation Committee in setting compensation for the NEOs and, in the case of the CEO’s compensation, making recommendations to the independent directors. Additional detail is provided in the compensation tables and the accompanying narrative disclosures that follow this discussion and analysis.

Our Compensation Philosophy and Objectives

As one of the largest retailers in the world, our executive compensation philosophy is to attract and retain the best management talent and to motivate these employees to achieve our business and financial goals. Kroger’s incentive plans are designed to reward the actions that lead to long-term value creation. The Compensation Committee believes that there is a strong link between our business strategy, the performance metrics in our short-term and long-term incentive programs, and the business results that drive shareholder value.

We believe our strategy creates value for shareholders in a manner consistent with our focus on our core values: honesty, integrity, respect, inclusion, diversity and safety.

To achieve our objectives, the Compensation Committee seeks to ensure that compensation is competitive and that there is a direct link between pay and performance. To do so, it is guided by the following principles:

| |

| |

| |

| |

| |

| |

|

17

Components of Executive Compensation at Kroger

Compensation for our NEOs is comprised of the following:

| |

The annual and long-term performance-based compensation awards described herein were made pursuant to our 2011 Long-Term Incentive and Cash Bonus Plan and our 2014 Long-Term Incentive and Cash Bonus Plan, each of which was approved by our shareholders in 2011 and 2014, respectively.

Annual Compensation – Salary

Our philosophy with respect to salary is to provide a sufficient and stable source of fixed cash compensation. All of our compensation cannot be at-risk or long-term. It is important to provide a meaningful annual salary to attract and retain a high caliber leadership team, and to have an appropriate level of cash compensation that is not variable.

Salaries for the NEOs (with the exception of the CEO) are established each year by the Compensation Committee, in consultation with the CEO. The CEO’s salary is established by the independent directors. Salaries for the NEOs are reviewed annually in June.

The amount of each NEO’s salary is influenced by numerous factors including:

The assessment of individual contribution is a qualitative determination, based on the following factors:

18

The amounts shown below reflect the salaries of the NEOs effective at the end of each fiscal year.

| Salary | ||||||||

| 2013 | 2014 | 2015 | ||||||

| W. Rodney McMullen(1) | $ | 1,100,000 | $ | 1,200,000 | $ | 1,240,000 | ||

| J. Michael Schlotman(2) | $ | 735,000 | $ | 760,000 | $ | 840,000 | ||

| Michael J. Donnelly(2) | $ | 643,560 | $ | 662,900 | $ | 750,000 | ||

| Christopher T. Hjelm(2)(3) | $ | 700,000 | ||||||

| Frederick J. Morganthall II(2)(3) | $ | 670,000 | ||||||

Annual Compensation – Performance-Based Annual Cash Bonus

The NEOs, along with approximately 13,000 of their fellow Kroger associates, participate in a performance-based annual cash bonus plan. Approximately 7,000 of those associates are eligible for the same plan as the NEOs. The remaining associates are eligible for an annual cash bonus plan of which 40% is based on the Kroger corporate plan and 60% is based on the metrics and targets for their respective supermarket division or operating unit of the Company.

Over time, the Compensation Committee and our independent directors have placed an increased emphasis on our strategic plan by making the targets more difficult to achieve. The annual cash bonus plan is structured to encourage high levels of performance. A threshold level of performance must be achieved before any payouts are earned, while a payout of up to 200% of target can be achieved for superior performance.

The amount of annual cash bonus that the NEOs earn each year is based upon Kroger’s performance compared to targets established by the Compensation Committee and the independent directors based on the business plan adopted by the Board of Directors.

The annual cash bonus plan is designed to encourage decisions and behavior that drive the annual operating results and the long-term success of the Company. Kroger’s success is based on a combination of factors, and accordingly the Compensation Committee believes that it is important to encourage behavior that supports multiple elements of our business strategy.

Establishing Annual Cash Bonus Potentials

The Compensation Committee establishes annual cash bonus potentials for each NEO, other than the CEO, whose annual cash bonus potential is established by the independent directors. Actual payouts, which can exceed 100% of the potential amounts but may not exceed 200% of the potential amounts, represent the extent to which performance meets or exceeds the goals established by the Compensation Committee. Actual payouts may be as low as zero if performance does not meet the goals established by the Compensation Committee.

The Compensation Committee considers multiple factors in making its determination or recommendation as to annual cash bonus potentials:

19

The annual cash bonus potential in effect at the end of the fiscal year for each NEO is shown below. Actual annual cash bonus payouts are prorated to reflect changes, if any, to bonus potentials during the year.

| Annual Cash Bonus Potential | ||||||||

| 2013 | 2014 | 2015 | ||||||

| W. Rodney McMullen(1) | $ | 1,500,000 | $ | 1,600,000 | $ | 1,650,000 | ||

| J. Michael Schlotman(2) | $ | 550,000 | $ | 550,000 | $ | 600,000 | ||

| Michael J. Donnelly(2) | $ | 425,000 | $ | 550,000 | $ | 600,000 | ||

| Christopher T. Hjelm(2)(3) | $ | 600,000 | ||||||

| Frederick J. Morganthall II(2)(3) | $ | 600,000 | ||||||

Annual Cash Bonus Plan Metrics and Connection to our Business Plan

The annual cash bonus plan has the following measurable performance metrics, all of which are interconnected, and individually necessary to sustain our business model and achieve our growth strategy:

|

| |

|

|

20

|

| |

|

| |

|

| |

|

|

The use of these four primary metrics creates checks and balances on the various behaviors and decisions that impact the long-term success of the Company. The ID Sales, EBITDA without fuel and Customer 1st Strategy metrics are weighted equally to highlight the need to simultaneously achieve all three metrics in order to maintain our growth.

We aligned the weighting of ID Sales and EBITDA without fuel metrics to emphasize sales growth balanced with the focus on profit. Kroger’s business is not sustainable if we merely increase our ID Sales, but do not have a corresponding increase in earnings. Furthermore, payouts in the ID Sales and EBITDA without fuel segments are interrelated. Achieving the goal for both the ID Sales and EBITDA without fuel results in a higher percentage payout on both elements. Achieving the target on one, but not the other will limit the payout percentage on both.

By supporting the Customer 1st Strategy and the Four Keys, we will better connect with our customers. Our unique competitive advantage is our ability to deliver on the Four Keys, which are the items that matter most to our customers, and it is that multi-faceted achievement that we believe drives our ID Sales growth.

As we strive to achieve our aggressive growth targets, we also continuously aim to reduce our operating costs as a percentage of sales, without fuel. Productivity improvements and other reductions in operating costs allow us to reduce costs in areas that do not matter to our customers so that we can

21

invest money in the areas that matter the most to our customers, like the Four Keys. We carefully manage operating cost reductions to ensure a consistent delivery of the customer experience. This again shows the need to have multiple metrics, to create checks and balances on the various behavior and decisions that are influenced by the design of the bonus plan.

Results of 2015 Annual Cash Bonus Plan

The 2015 goals established by the Compensation Committee, the actual 2015 results and the bonus percentage earned for each of the performance metrics of the annual cash bonus plan were as follows:

| Actual | ||||||||||||

| Performance | ||||||||||||

| Goals | Compared to | Amount | ||||||||||

| Target | Actual | Target | Weight | Earned | ||||||||

| Performance Metrics | Minimum | (100%) | Performance(1) | (A) | (B) | (A) x (B) | ||||||

| ID Sales | 2.1% | 4.1% | 5.0% | 134.3% | 30% | 40.3% | ||||||

| EBITDA without Fuel | $4.4384 | $5.2217 | $5.2351 | |||||||||

| Billion | Billion | Billion | 126.3%(2) | 30% | 37.9% | |||||||

| Customer 1stStrategy(3) | * | * | * | * | 30% | 39.0% | ||||||

| Over | Over | Over | 45.0% | 10% | 4.5% | |||||||

| Total Operating Costs as | budget by | budget by | budget by | |||||||||

| Percentage of Sales, | 25 basis | 5 basis | 16 basis | |||||||||

| without Fuel(4) | points | points | points | |||||||||

| 0% | 5.0% | |||||||||||

| Fuel Bonus(5) | [As described in the footnote below] | or 5% | ||||||||||

| Total Earned | 126.7% | |||||||||||

Following the close of the year, the Compensation Committee reviewed Kroger’s performance against each of the metrics outlined above and determined the extent to which Kroger achieved those objectives. The Compensation Committee believes our management produced outstanding results in 2015, measured against increasingly aggressive business plan objectives. Due to our performance when compared to the goals established by the Compensation Committee, and based on the business plan adopted by the Board, the NEOs and all other participants in the corporate annual cash bonus plan earned 126.7% of their bonus potentials.

In 2015, as in all years, the Compensation Committee retained discretion to reduce the annual cash bonus payout for all executive officers, including the NEOs, if the Compensation Committee determined for any reason that the bonus payouts were not appropriate given their assessment of Company performance. The independent directors retained that discretion for the CEO’s bonus. The Compensation Committee and the independent directors also retained discretion to adjust the goals for each metric

22

under the plan should unanticipated developments arise during the year. No adjustments were made to the goals in 2015. The Compensation Committee, and the independent directors in the case of the CEO, determined that the annual cash bonus payouts earned appropriately reflected the Company’s strong performance in 2015 and therefore should not be adjusted.

The actual annual cash bonus percentage payout for 2015 represented excellent performance that exceeded our business plan objectives, with the exception of operating costs as a percentage of sales, without fuel. The strong link between pay and performance is illustrated by a comparison of earned amounts under our annual cash bonus plan in previous years, such as 2009, 2010 and 2012, when payouts were less than 100%. In those years, we did not achieve all of our business plan objectives.A comparison of actual annual cash bonus percentage payouts in prior years demonstrates the variability of annual cash bonus incentive compensation and its strong link to our performance:

| Annual Cash Bonus | |||

| Fiscal Year | Payout Percentage | ||

| 2015 | 126.7 | % | |

| 2014 | 121.5 | % | |

| 2013 | 104.9 | % | |

| 2012 | 85.9 | % | |

| 2011 | 138.7 | % | |

| 2010 | 53.9 | % | |

| 2009 | 38.5 | % | |

| 2008 | 104.9 | % | |

| 2007 | 128.1 | % | |

| 2006 | 141.1 | % | |

As described above, the annual cash bonus payout percentage is applied to each NEO’s bonus potential, which is determined by the Compensation Committee, and the independent directors in the case of the CEO. The actual amounts of performance-based annual cash bonuses paid to the NEOs for 2015 are reported in the Summary Compensation Table in the “Non-Equity Incentive Plan Compensation” column and footnote 4 to that table.

Long-Term Compensation

The Compensation Committee believes in the importance of providing an incentive to the NEOs to achieve the long-term goals established by the Board. As such, a majority of compensation is conditioned on the achievement of the Company’s long-term goals and is delivered via four long-term compensation vehicles: long-term cash bonus, performance units, stock options and restricted stock. Long-term compensation promotes long-term value creation and discourages the over-emphasis of attaining short-term goals at the expense of long-term growth.

The Compensation Committee considers several factors in determining the target value of long-term compensation awarded to the NEOs or, in the case of the CEO, recommending to the independent directors the amount awarded. These factors include:

| |

23

Long-term incentives are structured to be a combination of performance- and time-based compensation that reflects elements of financial and stock performance to provide both retention value and alignment with company performance. Long-term cash bonus and performance unit payouts are contingent on the achievement of certain strategic performance and financial measures and incentivize recipients to promote long-term value creation and enhance shareholder wealth by supporting the Company’s long-term strategic goals. Stock options and restricted stock are linked to stock performance creating alignment between executives and company shareholders. Options have no initial value and recipients only realize benefits if the value of our stock increases following the date of grant.

A majority of long-term compensation is equity-based (performance units, stock options, and restricted stock) and is tied to the future value of our common shares, further aligning the interests of our NEOs with our shareholders. All four components of long-term compensation are intended to focus executive behaviors on our long-term strategy. Each component is described in more detail below.

Amounts of long-term compensation awards issued and outstanding for the NEOs are set forth in the tables that follow this discussion and analysis.

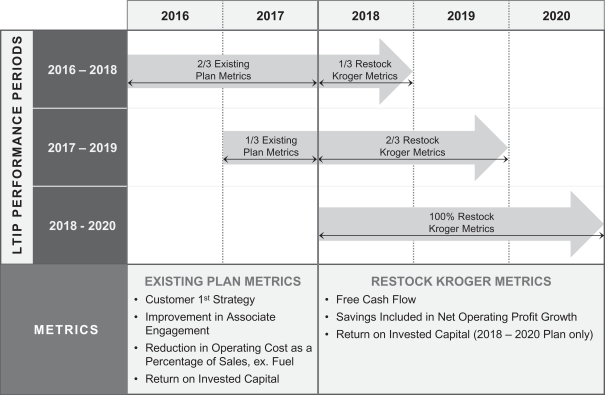

Long-Term Incentive Plan Design

In contrast to the performance-based annual cash bonus plan, described above, which has approximately 13,000 participants, our performance-based Long-Term Incentive Plan has approximately 160 participants, including the NEOs. Each year we adopt a similar Long-Term Incentive Plan, which provides for overlapping three year performance periods. The Long-Term Incentive Plan consists of a performance-based long-term cash bonus and performance units which has the following characteristics:

| |

| |

| |

| |

| |

|

The Compensation Committee anticipates adopting a new Long-Term Incentive Plan each year, measuring improvement over successive three-year periods. Each year when establishing the performance metric baselines and percentage payouts per unit of improvement, the Compensation Committee considers the difficulty of achieving compounded improvement over time. During 2015, Kroger awarded 503,276 performance units to approximately 160 employees, including the NEOs.

24

Long-Term Incentive Plan Metrics and Connection to our Business Strategy

25

The following table summarizes the Long-Term Incentive Plans adopted for the years shown:

The Compensation Committee has made adjustments to the percentage payouts for the components of the Long-Term Incentive Plans over time to account for the increasing difficulty of achieving compounded improvement.

During 2015, Kroger awarded 503,276 performance units to approximately 160 employees, including the NEOs.

26

Results of 2013 Long-Term Incentive Plan

The 2013 Long-Term Incentive Plan, which measured improvements over the three year period from 2013 to 2015, paid out in March 2016 and was calculated as follows:

| Payout per | Percentage | ||||||||||||

| Improvement | Improvement | Earned | |||||||||||

| Metric | Baseline | Result(1) | (A) | (B) | (A) x (B) | ||||||||

| Customer 1st | 12 units of | ||||||||||||

| Strategy(2) | * | * | improvement | 2.00% | 24.00 | % | |||||||

| Improvement | |||||||||||||

| in Associate | 2 units of | ||||||||||||

| Engagement(2) | * | * | improvement | 4.00% | 8.00 | % | |||||||

| Reduction in Operating | |||||||||||||

| Cost as a Percentage | 56 basis point | ||||||||||||

| of Sales, without Fuel | 26.69% | 26.13% | improvement | 0.50% | 28.00 | % | |||||||

| Return on Invested | 66 basis point | ||||||||||||

| Capital | 13.27% | 13.93% | improvement | 1.00% | 66.00 | % | |||||||

| Total | 126.00 | % | |||||||||||

| Total Earned: Payout is | |||||||||||||

| capped at 100% | 100.00 | % | |||||||||||

Accordingly, each NEO received a long-term cash bonus in an amount equal to 100% of that executive’s long-term cash bonus potential, and was issued the number of Kroger common shares equal to 100% of the number of performance units awarded to that executive, along with a cash amount equal to the dividends paid on that number of common shares during the three year performance period. Payout for the cash components of the 2013 Long-Term Incentive Plan are reported in the “Non-Equity Incentive Plan Compensation” and “All Other Compensation” columns of the Summary Compensation Table and footnotes 4 and 6 to that table, and the common shares issued under the plan are reported in the 2015 Option Exercises and Stock Vested Table and footnote 2 to that table.

Stock Options and Restricted Stock

Stock options and restricted stock continue to play an important role in rewarding NEOs for the achievement of long-term business objectives and providing incentives for the creation of shareholder value.Awards based on Kroger’s common shares are granted annually to the NEOs and a large number of other employees. Kroger historically has distributed time-based equity awards widely, aligning the interests of employees with your interest as shareholders.

In 2015, Kroger granted 3,425,720 stock options to approximately 1,222 employees, including the NEOs. The options permit the holder to purchase Kroger common shares at an option price equal to the closing price of Kroger common shares on the date of the grant.

During 2015, Kroger awarded 3,228,270 shares of restricted stock to approximately 8,280 employees, including the NEOs.

Options are granted only on one of the four dates of Board meetings conducted after Kroger’s public release of its quarterly earnings results. The Compensation Committee determines the vesting schedule for stock options and restricted stock.

During 2015, the Compensation Committee granted to the NEOs: (a) stock options with a five-year vesting schedule; and (b) restricted stock with a three- or five-year vesting schedule.

27

As discussed below under Stock Ownership Guidelines, covered individuals, including the NEOs, must hold 100% of common shares issued pursuant to performance units earned, the shares received upon the exercise of stock options or upon the vesting of restricted stock, except those necessary to pay the exercise price of the options and/or applicable taxes, until applicable stock ownership guidelines are met, unless the disposition is approved in advance by the CEO, or by the Board or Compensation Committee for the CEO.

Retirement and Other Benefits

Kroger maintains a defined benefit and several defined contribution retirement plans for its employees. The NEOs participate in one or more of these plans, as well as one or more excess plans designed to make up the shortfall in retirement benefits created by limitations under the Internal Revenue Code on benefits to highly compensated individuals under qualified plans. Additional details regarding certain retirement benefits available to the NEOs can be found below in the 2015 Pension Benefits Table and the accompanying narrative description that follows this discussion and analysis.

Kroger also maintains an executive deferred compensation plan in which some of the NEOs participate. This plan is a nonqualified plan under which participants can elect to defer up to 100% of their cash compensation each year. Additional details regarding our nonqualified deferred compensation plans available to the NEOs can be found below in the Nonqualified Deferred Compensation Table and the accompanying narrative.

Kroger also maintains The Kroger Co. Employee Protection Plan (“KEPP”), which covers all of our management employees and administrative support personnel who have provided services to Kroger for at least one year and whose employment is not covered by a collective bargaining agreement. KEPP provides for severance benefits and extended Kroger-paid health care, as well as the continuation of other benefits as described in the plan, when an employee is actually or constructively terminated without cause within two years following a change in control of Kroger (as defined in KEPP). Participants are entitled to severance pay of up to 24 months’ salary and bonus. The actual amount is dependent upon pay level and years of service. KEPP can be amended or terminated by the Board at any time prior to a change in control.

Performance-based long-term cash bonus, performance unit, stock option, and restricted stock agreements with award recipients provide that those awards “vest,” with 50% of the long-term cash bonus potential being paid, common shares equal to 50% of the performance units being awarded, options becoming immediately exercisable, and restrictions on restricted stock lapsing upon a change in control as described in the grant agreements.

None of the NEOs is party to an employment agreement.

Perquisites

NEOs receive limited perquisites because the Compensation Committee does not believe that it is necessary for the attraction or retention of management talent to provide the NEOs a substantial amount of compensation in the form of perquisites. In 2015, the only perquisites available to our NEOs were:

| |

| |

|

Because he was an officer of Harris Teeter during 2015, Mr. Morganthall also was eligible for the following Harris Teeter perquisites:

| |

|

The total amount of perquisites furnished to the NEOs is shown in the Summary Compensation Table and described in more detail in footnote 6 to that table.

28

Process for Establishing Executive Compensation

The Compensation Committee of the Board has the primary responsibility for establishing the compensation of our executive officers, including the NEOs, with the exception of the Chief Executive Officer. The Compensation Committee’s role regarding the CEO’s compensation is to make recommendations to the independent members of the Board; those members of the Board establish the CEO’s compensation.

The Compensation Committee directly engages a compensation consultant from Mercer Human Resource Consulting to advise the Compensation Committee in the design of compensation for executive officers.

The Mercer consultant conducts an annual competitive assessment of executive positions at Kroger for the Compensation Committee. The assessment is one of several bases, as described above, on which the Compensation Committee determines compensation. The consultant assesses:

| |

| |

| |

| |

|

The consultant compares these elements against those of other companies in a group of publicly-traded food and drug retailers. For 2015, our peer group consisted of:

This peer group is the same group as was used in 2014. Median 2015 revenue for the peer group was $92.5 billion, compared to our revenue of $109.8 billion. The make-up of the compensation peer group is reviewed annually and modified as circumstances warrant. Industry consolidation and other competitive forces will result in changes to the peer group over time.

The consultant also provides the Compensation Committee data from “general industry” companies, a representation of major publicly-traded companies of similar size and scope from outside the retail industry. This data serves as reference points, particularly for senior staff positions where competition for talent extends beyond the retail sector.